Check E File Status

Check E-File Status | H&R Block

There are a few ways to check your e-file status. Go to the H&R Block Where’s My Refund page to check the status of your e-filed tax return. Create or sign in to your MyBlock account. Download the free H&R Block mobile app for the iPhone, iPad, or Android. Open it and choose Refund Status to continue.

https://www.hrblock.com/tax-center/filing/efile/check-efile-status-hr-block/

How do I check my e-file status? - Intuit

To check your e-file status, sign in to TurboTax, and go to Tax Home (if you're not already there). If you've submitted your return, you'll see pending, rejected, or accepted status. If you haven't submitted your return yet, you'll see a let's keep working on your taxes! message and sections like Personal Info and Income & Expenses.

https://ttlc.intuit.com/turbotax-support/en-us/help-article/electronic-filing/check-e-file-status/L9XhHDPtD_US_en_US

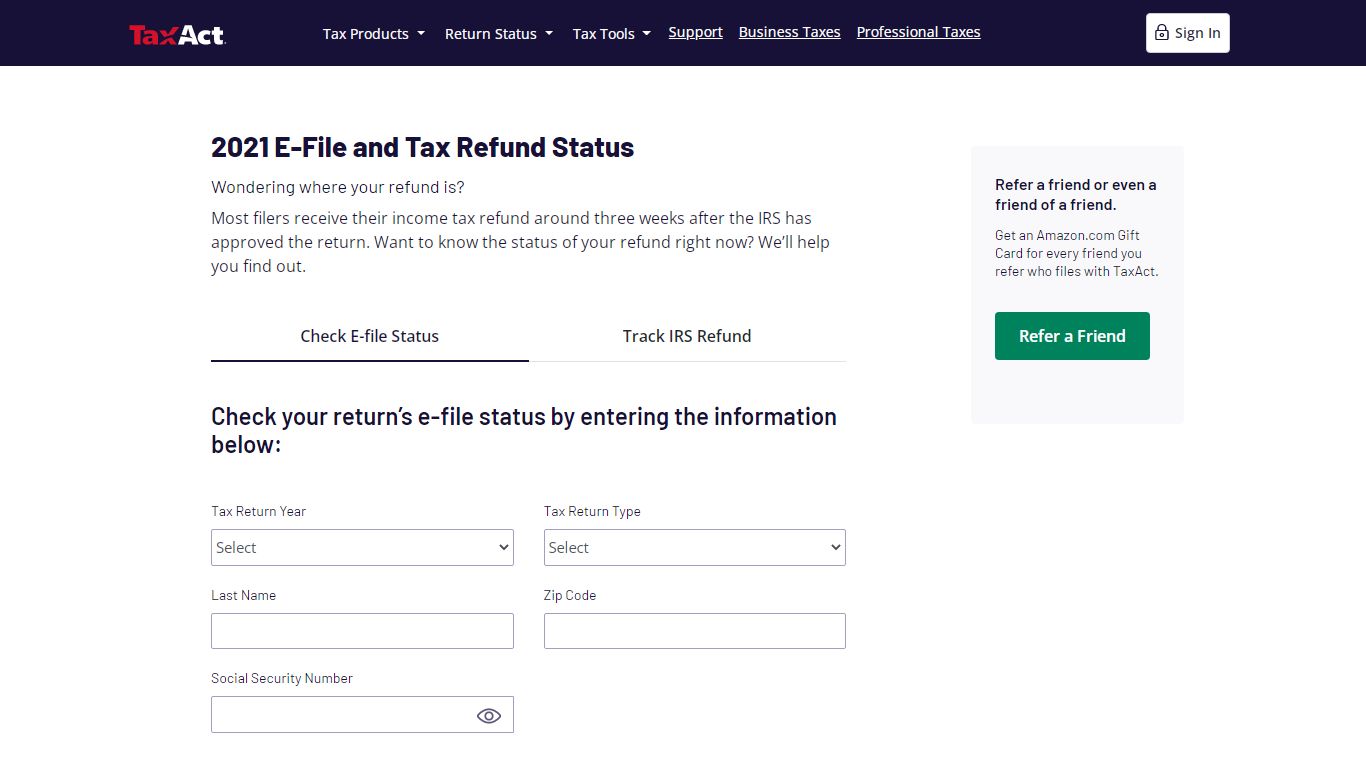

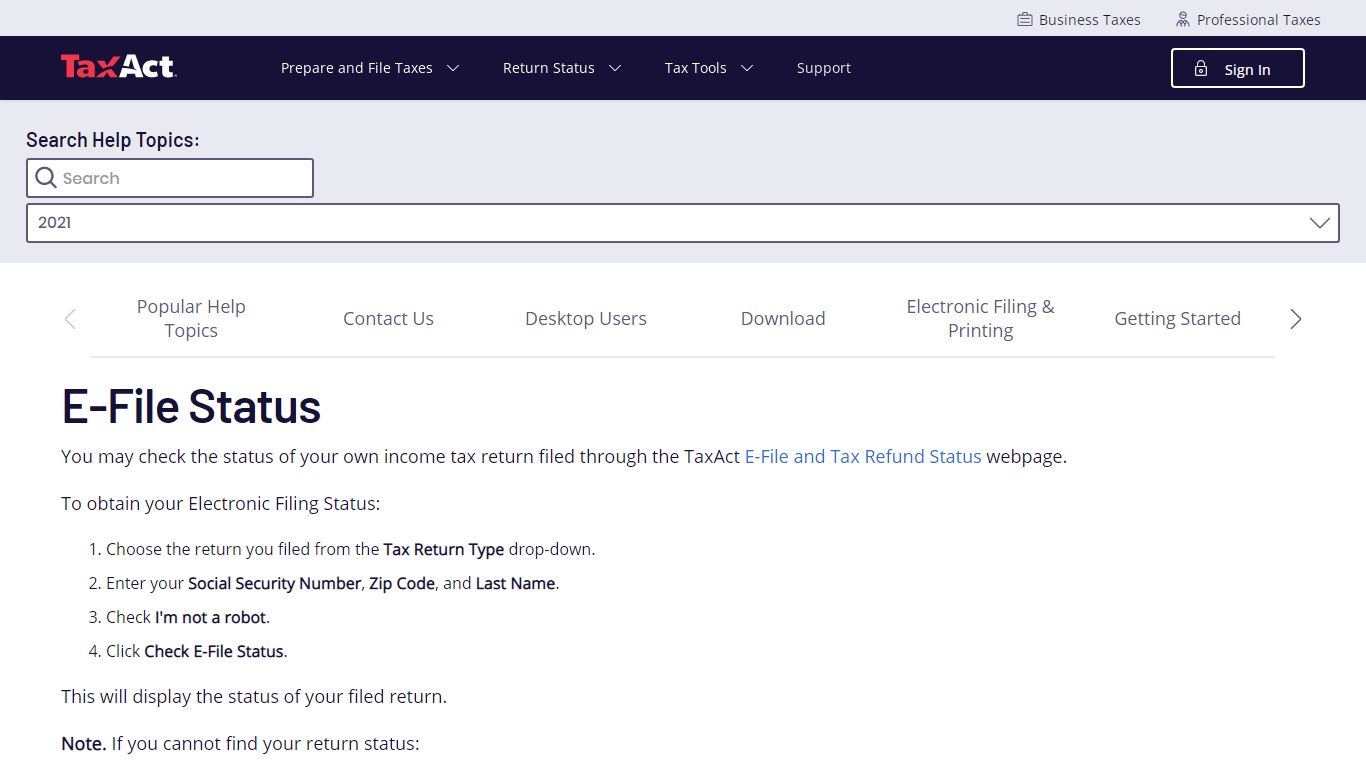

Where's My Refund | Check E-file Status | TaxAct

Sign In 2021 E-File and Tax Refund Status Most filers receive their income tax refund around three weeks after the IRS has approved the return. Want to know the status of your refund right now? We’ll help you find out. Tax Return Year Tax Return Type Social Security Number States - Where's My Refund? Want to check your state tax refund status?

https://www.taxact.com/post-filing/efile-status

TurboTax® Where's My Refund, Check e-File Status, Get Your Tax Return ...

You can easily check your e-file status online with TurboTax. IRS e-file statuses Once you prepare and submit your return, your e-file status is pending. This means it’s on its way to the IRS, but they haven’t acknowledged receiving it yet. This status can last anywhere from a few hours to a few days.

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

E-File Status - TaxAct

You may check the status of your own income tax return filed through the TaxAct E-File and Tax Refund Status webpage. To obtain your Electronic Filing Status: Choose the return you filed from the Tax Return Type drop-down. Enter your Social Security Number, Zip Code, and Last Name. Check I'm not a robot. Click Check E-File Status.

https://www.taxact.com/support/24702/2021/e-file-status

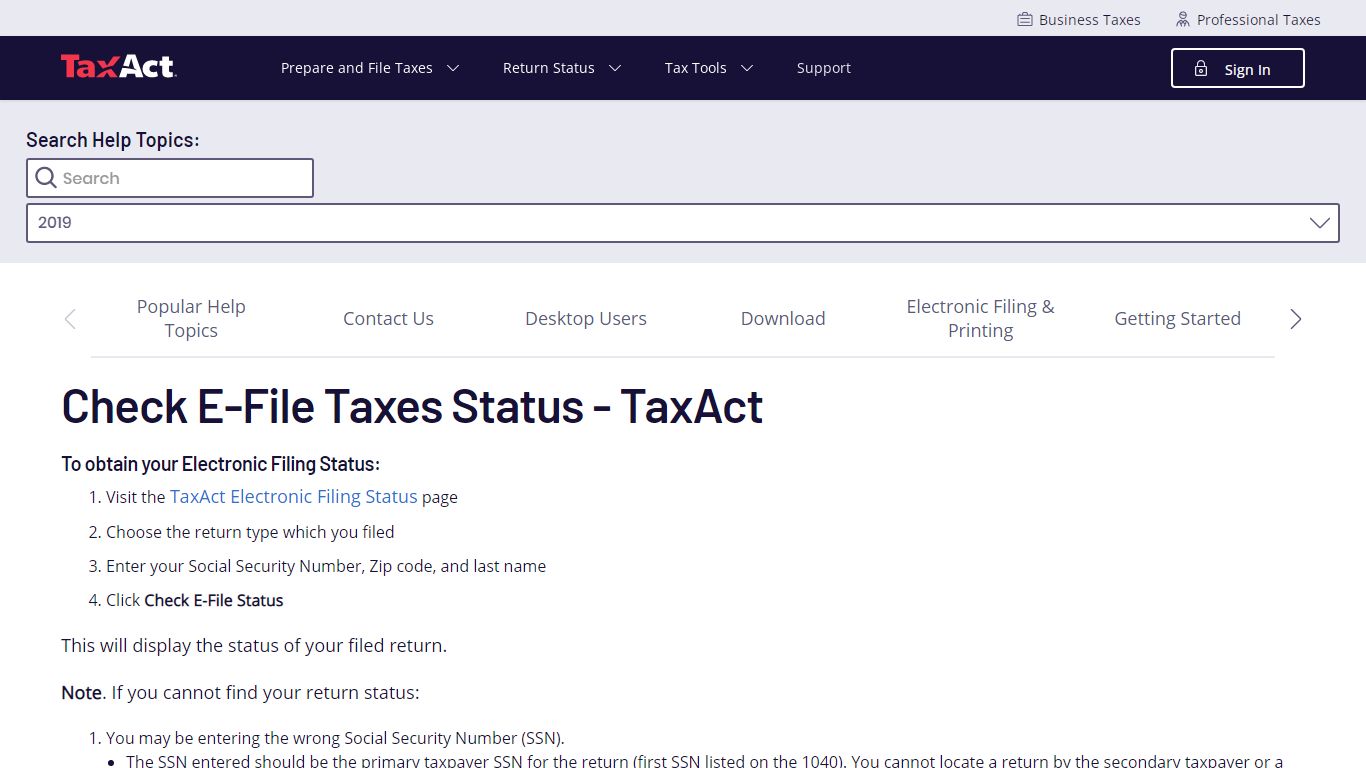

Steps to Check Your Electronic Filing Status | TaxAct Support

Visit the TaxAct Electronic Filing Status page Choose the return type which you filed Enter your Social Security Number, Zip code, and last name Click Check E-File Status This will display the status of your filed return. Note. If you cannot find your return status: You may be entering the wrong Social Security Number (SSN).

https://www.taxact.com/support/343/2019/check-e-file-taxes-status-taxact

How to Check the Status of E-filed Forms

1) Select E-file and then select Check Status of Filed Forms. On the Pop up enter your password, and click log in 2) A web browser will open, logging you in to your e-file account and navigating you to the Filing > Filed Forms Status - when forms were submitted to the IRS you can view the date your forms were e-filed.

https://support.custsupp.com/hc/en-us/articles/210239526-How-to-Check-the-Status-of-E-filed-FormsCheck the status of your refund | Internal Revenue Service - IRS tax forms

You can start checking on the status of you return within 24 hours after the IRS received your e-filed return, or four weeks after mailing a paper return. Generally, the IRS issues most refunds in less than 21 days, but some may take longer. On the go? Track your refund status using the free IRS2Go app.

https://www.irs.gov/newsroom/check-the-status-of-your-refund

Your Tax Return Refund Status; Check IRS Tax Status Online Free - e-File

Step 1: Check your Tax RETURN Status Check your tax return on eFile.com ( only if you prepared and e-filed at eFile.com ). If you e-filed your tax return at a different site, please sign in to your account on that site; eFile.com cannot provide tax return status information for other websites or tax offices.

https://www.efile.com/tax-refund/tax-refund-status/

Your 2021 Tax Return Status in 2022 After e-Filing Your Taxes

Steps to check your tax return status: Sign in here to your existing eFile.com account. Once you have signed in, you will see your return status on the front page. You do not have to navigate anywhere to find it - the message will display some additional information regarding your return, such as the acceptance date.

https://www.efile.com/my-tax-return-status/

What Is My Filing Status? | Internal Revenue Service - IRS tax forms

Your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct tax. If more than one filing status applies to you, this interview will choose the one that will result in the lowest amount of tax. Information You'll Need

https://www.irs.gov/help/ita/what-is-my-filing-status

Electronic Filing (e-file) | Internal Revenue Service - IRS tax forms

Frequently Asked Question Subcategories for Electronic Filing (e-file) Age, Name or SSN Rejects, Errors, Correction Procedures. Amended Returns. Forms W-2 & Other Documents. Due Dates & Extension Dates for e-file. Back to Frequently Asked Questions.

https://www.irs.gov/faqs/electronic-filing-e-file